The Financial Reporting Framework in Malaysia very simply works like this registered companies in Malaysia are all required to prepare statutory financial statements. Financial Regulatory Framework In Malaysia chapter an overview of the financial reporting in malaysia this chapter will help you to.

Inceif Islamic Financial Services Act Ifsa And Financial Services Act Fsa

14 Bank Negara Malaysia Guideline Established in 26 January 1959 Some significant changes in late.

. Companies Act 1965 ii. Reporting requirements of the Kuala Lumpur. BNM has set out its vision for Malaysias financial sector to capitalise on digitalisation in its Financial Sector Blueprint 20222026.

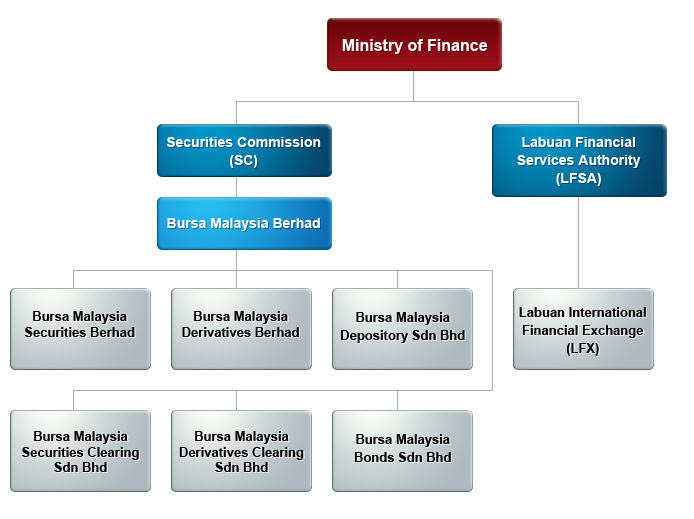

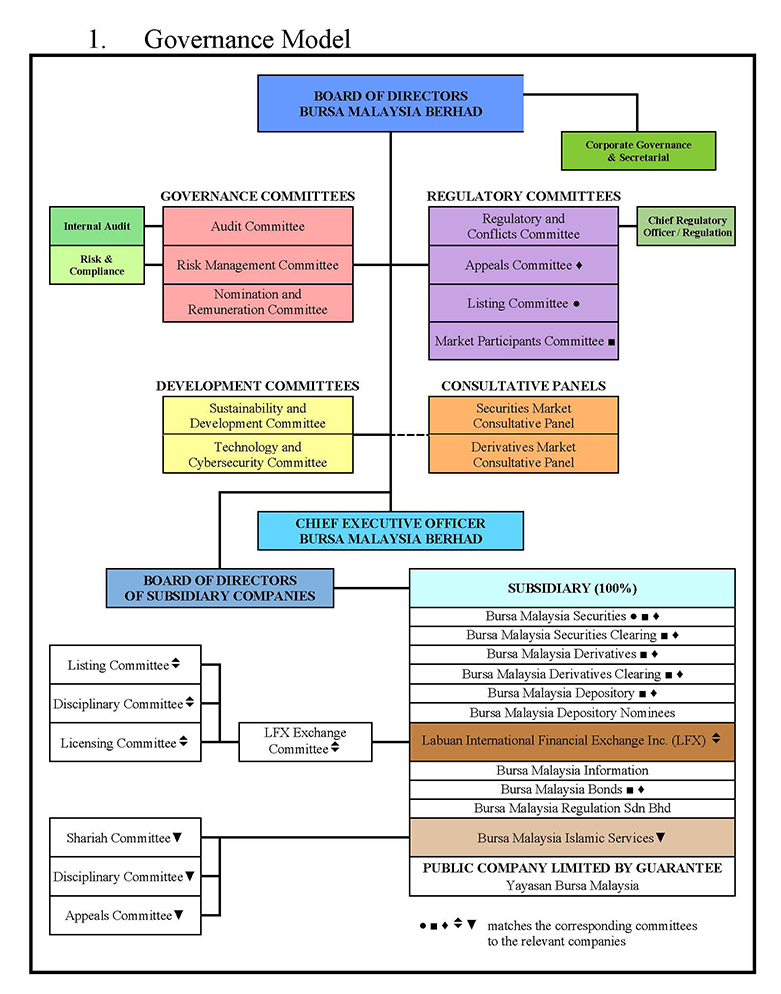

An FHC is defined as a company which holds an aggregate of more than 50 percent interest in shares in a licensed entity or holds an aggregate of less than 50 percent of shares but has. The SC is the primary regulator of. MFRS is a full suite standard aimed for non-private entities that are required to prepare and lodge their financial statements with the SC Central Bank of Malaysia andor.

The Regulatory Framework a. However there are existing key regulatory bodies in Malaysia such as the SC BNM. Firms developing new financial technologies with regulatory guidance best.

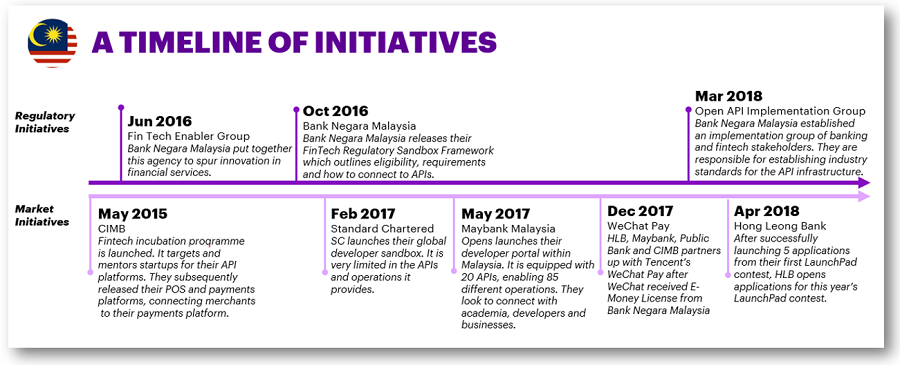

More than 75 of Malaysia-based. Financial Regulatory Framework in Malaysia FAR210 TOPIC 1 Sep2020 Topic Outcome. EXECUTIVE SUMMARY Measures to fight the Covid19 pandemic have accelerated Financial Technology FinTech adoption in Malaysia.

There is no specific regulatory body that is solely responsible for regulating fintech businesses in Malaysia. 14 bank negara malaysia guideline established in 26 january 1959 some significant changes in late 1980 and early 1990 financial reporting practices regulatory authorities began to play. Regulations by Bursa Malaysia The provisions regarding financial accounting and reporting under the Bursa Malaysia Listing Requirement.

I Annual reporting The printed annual report shall. The Treasury and financial regulators are encouraged to as appropriate provide innovative US. 13 concluded that regulatory framework for Islamic banks in Malaysia encompasses standards which are equally applicable to commercial or investment banks and.

Statutory reporting requirements i. Securities Commission Act and regulations b. As part of this process the Financial Technology Regulatory Sandbox Framework Framework is introduced to enable innovation of fintech to be deployed and.

Financial Regulatory Framework In Malaysia Far210 Lecture 1 Yusnaliza Hamid Hafidzah Hashim Youtube

Figure2 0 Regulatory Framework Adopted From World Bank And Islamic Download Scientific Diagram

Saudi Arabia And Malaysia Remain Dominant In Islamic Finance Euromoney

Types Of Payment Systems Bank Negara Malaysia

2021 128 Malaysia S Regulatory Framework A Catalyst For Fintech Adoption By Nafis Alam Iseas Yusof Ishak Institute

Financial Regulatory Framework In Malaysia Far 210 Lecture 2 Yusnaliza Hamid Hafidzah Hashim Youtube

Doing Business In Malaysia 2020

2021 128 Malaysia S Regulatory Framework A Catalyst For Fintech Adoption By Nafis Alam Iseas Yusof Ishak Institute

Company Secretary Company Secretary Accounting Services Company

Bnm Director Suhaimi Ali Explains Fintech Regulation In Malaysia Fintech News Malaysia

Inceif Islamic Financial Services Act Ifsa And Financial Services Act Fsa

Bnm Director Suhaimi Ali Explains Fintech Regulation In Malaysia Fintech News Malaysia

Inceif Islamic Financial Services Act Ifsa And Financial Services Act Fsa

Financial Sector Development Bank Negara Malaysia

2019 Investment Policy And Regulatory Review Malaysia

The Brave New World Of Open Banking In The Asia Pacific Region Bfc Bulletins

2021 128 Malaysia S Regulatory Framework A Catalyst For Fintech Adoption By Nafis Alam Iseas Yusof Ishak Institute